NAVIGATION

- Start-up Policies

- Essential Knowledge

- Tax & Law

- Visa & Immigrant

- Setting up a company

back

创建一个账号,浏览更多内容 •••

Pay attention to

CITYPLUS website WeChat

Please download

CITYPLUS APP

Subsidy policies for individuals

个人政策

Policies for enterprises

企业政策

High-level foreign talent refers to high-level foreign experts and returning students from overseas involved in three areas, namely:enterprise technology and innovative enterprises; scientific research and health education; arts, culture and sports. High-level foreign experts are classified into Category A and B, while returning students from overseas are classified into Category A, B and C. Category A talent refers to the national leading talent specified in Measures for the Determination of High-Level Professional Talent of Shenzhen (Trial); Category B talent refers to local leading talent; and Category C talent refers to reserve talent.

1、Abides by the law, possesses good occupational ethics and a rigorous research attitude, adheres to science and facts and the spirit of teamwork and cooperation;

2、High-level foreign experts must have an employment contract of more than one year with the hiring organization. Returning students from overseas must be high-achieving individuals who intend to be entrepreneurs in Shenzhen or have signed an employment contract with an organization based in Shenzhen.

3、Meets the age requirement:

(1) Category A high-level foreign talent must be 60 years old or below;

(2) Category B high-level foreign talent must be 55 years old or below;

(3) Category C high-level foreign talent must be 40 years old or below.

Specific applicant criteria :

Nobel laureates, recipients of prestigious international awards, academicians of the Chinese Academy of Sciences and Chinese Academy of Engineering, leaders of renowned enterprises or world-renowned organizations, recipients of prestigious international awards for specialized fields, etc.

Specific applicant criteria :

Internationally-renowned academicians, provincial-level leading talent, heads of internationally renovwned tertiary institutions, recipients of prestigious international awards for specialized fields, etc.

Specific applicant criteria :

Individuals who have served as assistant professors at prestigious foreign universities, core members of teams of high-level foreign talent, performers in world-renowned orchestras, principal inventors of patented inventions, etc.

Subsidy rate = (paid income tax amount - taxable income)*15%

15% of the excess of paid income tax amount over t.3he taxableincome will be subsidized

Income tax is exempt for the amount subsidized.

Enquiry details:

0755-88988988 (8:00-12:00/13:30-19:00 on working days)

Office address:

Service Center, Qianhai E Station, Building A, No. 1, Qianwan 1st Road, Qianhai Shenzhen-Hong Kong Cooperation Zone

For more detaills

please scan the QR code

Innovative enterprises formed by teams of high-level foreign and local talent.

Focus areas of subsidy:Internet, biology, new energy, new materials, new generation IT, energy saving and environmental protection, maritime, aerospace, health and life sciences, robotics, wearable devices, smart devices or other emerging industries.

Funding for single projects ranges from RMB 10 million to 100 million, with an average funding amount of RMB 20 million. Funding for foreign youth teams is RMB 20 million maximum. For teams that are attached to enterprises, the funding amount shall not be higher than 50% of the total project budget declared.

Contact number: 88121039, 88102204

Address: Administrative Services West Hall, Civic Center.

For more detaills

please scan the QR code

Subsidy for rental of premises by enterprises that have received the special enterprise funding or team funding for innovative enterprises formed by high-level foreign talent, or the funding by Guangdong Province for innovation research teams.

1.The number of allocations are restricted, due to a control over the annual special subsidy amount for innovative enterprises formed by high-level foreign talent.

2. Within two years of its establishment, the enterprise’s rent will be subsidized at a rate of RMB 30/m²/month for an area of up to 500 m². On the third year of its establishment, the enterprise’s rent will be subsidized at a rate of RMB 15/m²/month for an area of up to 500 m². The application deadline for the subsidy is December 31, 2017.

Contact number: 88121039, 88102204

Address: Administrative Services West Hall, Civic Center.

For more detaills

please scan the QR code

Funding for research and development projects and projects for the practical application of research outcomes led by high-level foreign talent.

Focus areas of subsidy:Internet, biology, new energy, new materials, new generation IT and other strategic emerging industries; maritime, aerospace, health and life sciences, and other future potential industries; high-tech manufacturing and technological areas that improve people’s quality of living.

The average funding amount is RMB 1 million, due to a control over the annual special subsidy amount for innovative enterprises formed by high-level foreign talent.

Contact number: 88121039, 88102204

Address: Administrative Services West Hall, Civic Center.

For more detaills

please scan the QR code

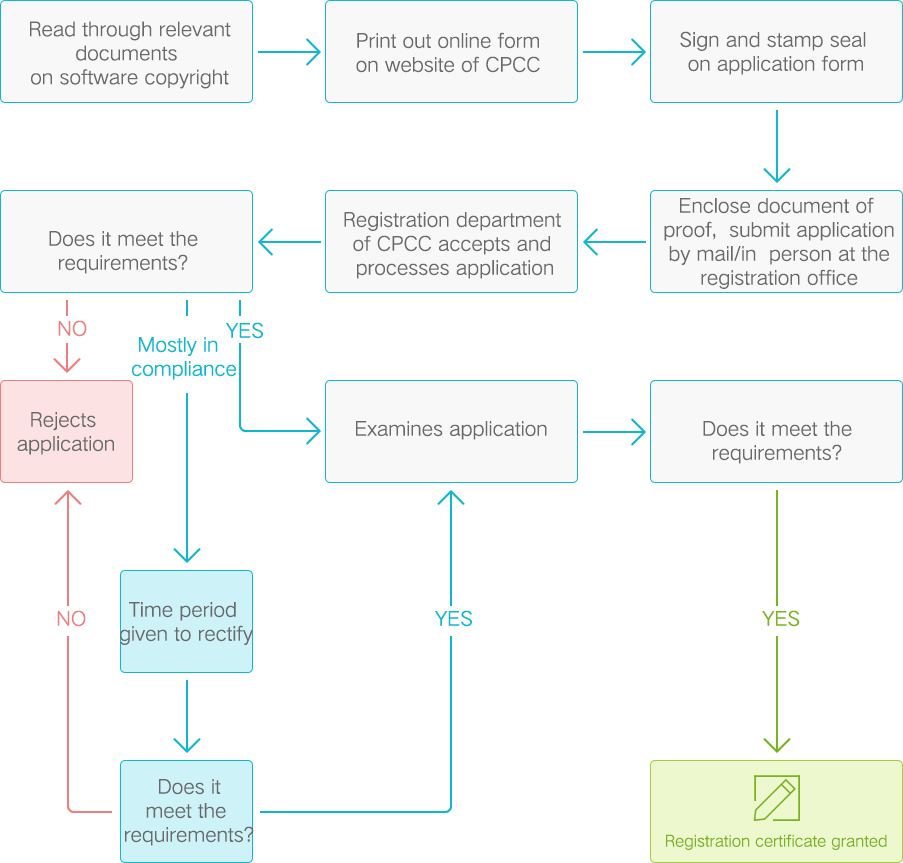

Enterprises and individual entrepreneurs who have obtained the Certificate of Copyright Registration for Computer Software.

1.The applicant is required to register with the Copyright Protection Center of China within one year of completing the development of a computer software, and to apply for the subsidy within six months of obtaining the Certificate of Copyright Registration for Computer Software. Each software is subsidized for RMB 600.

2.For individuals or enterprises represented by a Shenzhen intellectual property agency or the Shenzhen branch of a larger scale of a foreign intellectual property agency (where the latter’s paid tax amount for the previous year needs to be RMB 200,000 or above), the subsidy for each software item will be increased by RMB 300.

Telephone enquiry: 0755-12315,0755-88127758

Office: Administrative Services East Hall, 1st Floor, Zone B, Fuzhong 3rd Road, Futian District, Shenzhen

For more detaills

please scan the QR code

Companies recognized as national high-tech enterprises.

Article 28 of the Enterprise Income Tax Law of the People’s Republic of China provides that high-tech enterprises are entitled to a 15% reduction in income tax rate, which is a 40% decrease of the original 25% tax rate.

Telephone enquiry: 0755-88127373, 0755-88100075

Office: Administrative Services West Hall, Zone B, Civic Center, Fuzhong 3rd Road, Futian District, Shenzhen

For more detaills

please scan the QR code

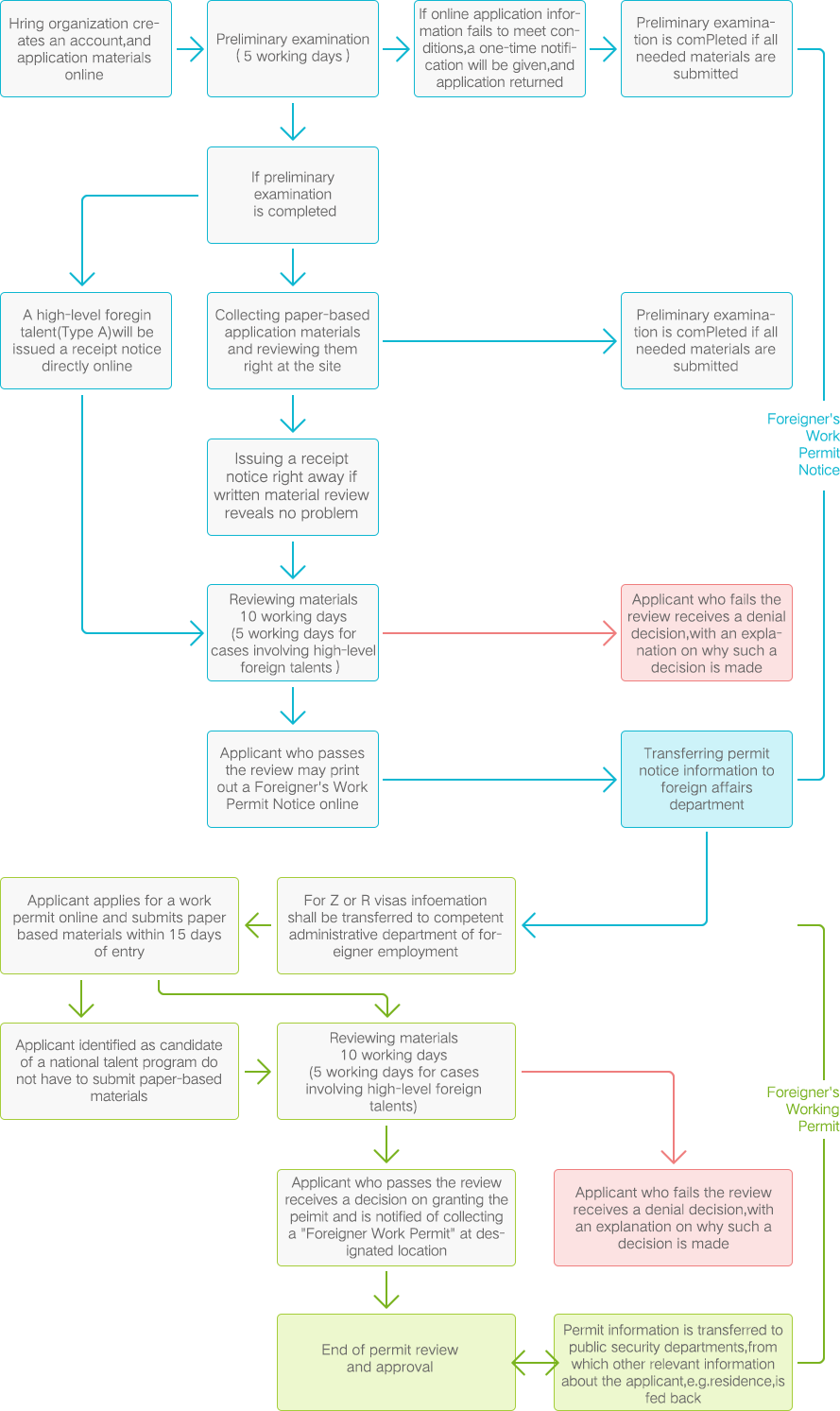

Choosing the right company type

公司性质选择

Intellectual property

知识产权

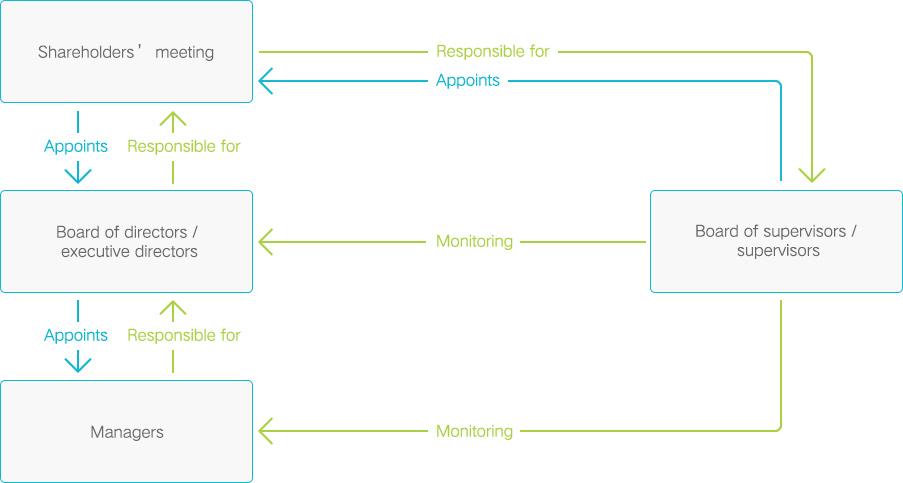

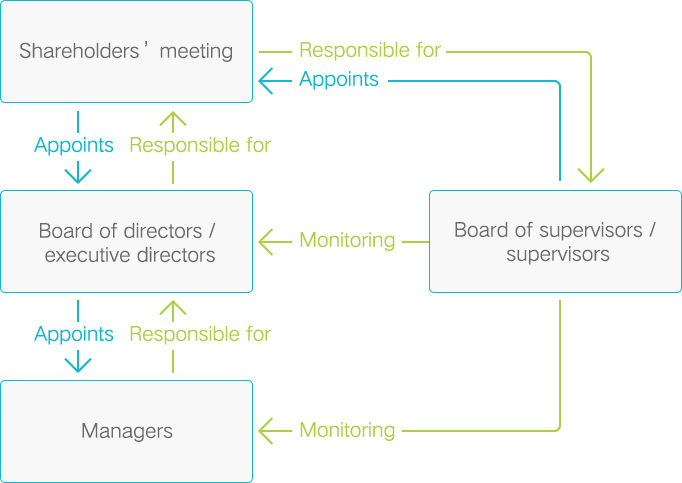

Relationship dlagram

Relationship dlagram

A wholly foreign-owned enterprise is a company, enterprise, commercial organization or individual that is established in China according to the laws of China and derives its total capital from foreign investors. These include sole ownership by natural persons and by legal entities.

(1)A rented office space for the company’s registered address;

(2)Sufficient start-up capital;

(3)One legal representative (who can be a shareholder, and can act as the executive director and general manager);

(4)One supervisor (who cannot be a senior executive);

(5)One financial manager is required (if personnel is insufficient, it can be assumed temporarily by a director);

(6)One person holding Chinese identification card is required as the company’s recipient of legal documents served within the country.

(1)The shareholders own 100% of the shares and can operate independently without having to consider the position of Chinese investors. The company can determine its own strategic goals;

(2) Compared to the restricted operations of the representative office, a wholly foreign-owned company can receive payments in RMB and issue invoices;

(3)No minimum registered capital requirements - shareholders may decide on an appropriate amount of registered capital according to the company’s future development needs. If the capital becomes insufficient later on for the company’s operation, it can be increased. It is not advisable to set the registered capital amount at RMB 1;

(4)No restrictions on registered capital - currencies such as RMB, HKD and USD may be used as the registered capital currency.

(1)Allowed to be set up only as a single-member limited liability company.

(2)Apart from one foreign member, there must also be another foreign person acting as a company supervisor.

John Doe is interested in exploring the consultancy market in China and would like to set up a consultancy company under his name in China. After operating for half a year, Foreigner A would like to develop software for his online consultancy business, which requires him to set up a technology company. Foreigner A needs to find Foreigner B or Foreign Company B to form a joint venture company, as he is not allowed to create another sole proprietor under his name.

A joint venture established in China according to the laws of China and jointly operated by a foreign company, enterprise, economic organization or individual and a Chinese company, enterprise, economic organization or individual.

(1)A rented office space for the company’s registered address;

(2)Sufficient start-up capital;

(3)At least one Chinese investor (enterprise) and one foreign investor (enterprise or individual);

(4)Three directors and one supervisor;

(5)One financial manager is required (if personnel is insufficient, it can be assumed temporarily by a director);/p>

(6)One person holding Chinese identification card is required as the company’s recipient of legal documents served within the country.

(1)A joint venture can benefit from shared resources with both parties leveraging their mutual strengths, and has easier access into the Chinese market by relying on the networks and established branding of the Chinese enterprise;

(2)The geographical advantage of a Chinese partner enterprise can help foreign investors reduce some of the financial expenditures reasonably and legally, thus lowering operational costs;

(3)Foreign businesses are entitled to certain benefits.

(1)The Chinese investors cannot be natural persons from China, but must be Chinese enterprises;

(2)The investment percentage of foreign investors must not generally be lower than 25%;

(3) A board of directors is mandatory, which will be the highest decision-making body of the company. The legal representative must be the chairman of the board and cannot be the general manager.

A, who is Australian, and B, who is Chinese, are good friends interested in exploring the cross-border e-commerce business in China. They have decided to form a company for the venture. They have been informed by the personnel at the Market Supervision and Regulation Bureau of Shenzhen Municipality that B has to first establish a domestic enterprise under his name, then form a company with A as a Chinese enterprise, or else they would not be allowed to register their company.

Question Answer

Question Answer

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

CN Web:

www.cnipa.gov.cn

EN Web:

english.cnipa.gov.cn

It is important for an entrepreneur to protect his or her intellectual property rights. With widespread presence of the Internet, a company’s product and design concepts are vulnerable to quick replication by its competitors, which can result in an immense loss to the entrepreneur.

Suggests entrepreneurs to visit the website of the China National Intellectual Property Administration to find out more about the relevant national policies relating to intellectual property rights and understand the application process for registering intellectual property rights.

Relevant authority: National Intellectual Property Department (please provide website and public QR code) (Chinese/English)

Chinese website:http://www.ncac.gov.cnEnglish

website:http://en.ncac.gov.cn

Copyright: The exclusive right owned by an author over his or her literary, artistic or scientific and technical work, and is a form of intangible property right. The main focus here is on copyright registration for computer software.

National Copyright Office WeChat

Applicants can apply for computer software copyright registration by themselves or entrust an agency to register.

Application information

Send in the application by registered mail or express mail to the software registration department of the Copyright Protection Center of China Mailing address: No. 302, 3rd Floor, Block A, Tianqiao Art Building, No. 1, Tianqiao South Street, Xicheng District, Beijing (Post Code: 100050)

①Telephone enquiry on software registration

Enquiry on software registration: 010—68003934, 64097080

Enquiry on application approval process: 010—84195634

Enquiry on mailing of certificates 010—68003887—5150

Enquiry on amendment of software registration: 010—84195640

②Telephone enquiry on software files and replacement of certificates

Enquiry on application approval process: 010—68003887—7050

③Complaints and suggestions on software registration: rjdj@ccopyright.com

1. Application Form for Software Copyright Registration;

2. Verification materials for software (programs, files);

3. Personal identification documents of applicant (photocopy of passport), personal identification documents of contact person, and other relevant documents of proof.

① Personal identification documents of agent: For applications handled by agents, the photocopies of the personal identification documents of the agent must be submitted, and the agent’s appointed tasks, scope of authority, period of service and other relevant matters must be specified in the application form.

② Personal identification documents of the applicant (stamp of official seal is required for organizations)

Protected works include:

(1) written works;

(2) oral works;

3) Music, drama, folk art, dance, acrobatic art works;

(4) Fine arts and architectural works;

(5) photographic works;

(6) Movie works and works created in a manner similar to filmmaking;

(7) Graphical works and model works such as engineering design drawings, product design drawings, maps, and schematic drawings;

(8) computer software;

(1) the term of protection of the author's rights of authorship, alteration, integrity and other personal rights shall not be restricted.

(2) for a work of a citizen, the term of protection of the 14 property rights prescribed by the law of publication and copyright shall be the life of the author and fifty years after his death, expiring on December 31 of the fiftieth year after his death; In the case of collaborative works, the deadline is December 31 of the fiftieth year after the death of the last deceased author.

(3) the legal person or other organization work, copyright (except the right of authorship) works created by the legal person or other organization, the right of publication and the copyright law protection of property rights of 14 for 50 years, ending on work December 31 of the fiftieth year after the first publication, but since the creation unpublished, fifty years after the completion of the law no longer protection.

(4) films and work is created by virtue of the analogous method of film, photography, the right of publication and the copyright law protection of property rights of 14 for 50 years, ending on work December 31 of the fiftieth year after the first publication, but since the creation in fifty years after the completion of unpublished, no longer protect the copyright law.

The works created by citizens to complete the tasks of legal persons or other organizations are job titles.Copyright is owned by the author except in the following cases, but legal persons or other organizations have the right to use it preferentially within their business. Within two years of the completion of the work, the author may not permit the third person to use the work in the same manner as the unit does without the consent of the unit.The author has the right to authorize the job in one of the following circumstances: the other rights of the copyright are enjoyed by the legal person or other organization, and the legal person or other organization may award the author:

(1) It is mainly an engineering design drawing, a product design drawing that is created by the legal or technical conditions of a legal person or other organization, and which is undertaken by a legal person or other organization.

Jobs such as maps and computer software;

(2) Jobs that are permitted by legal persons or other organizations as stipulated by laws, administrative regulations or contracts.

(1) Settlement: The parties have the intention to resolve themselves and can negotiate copyright disputes.

(2) Mediation: The parties may entrust a third party (copyright office, copyright protection agency such as China Copyright Agency, copyright protection association, law firm, and natural person) to mediate copyright disputes.

(3) Arbitration: The parties may apply to the arbitration institution for arbitration according to the written arbitration agreement reached or the arbitration clause in the copyright contract.

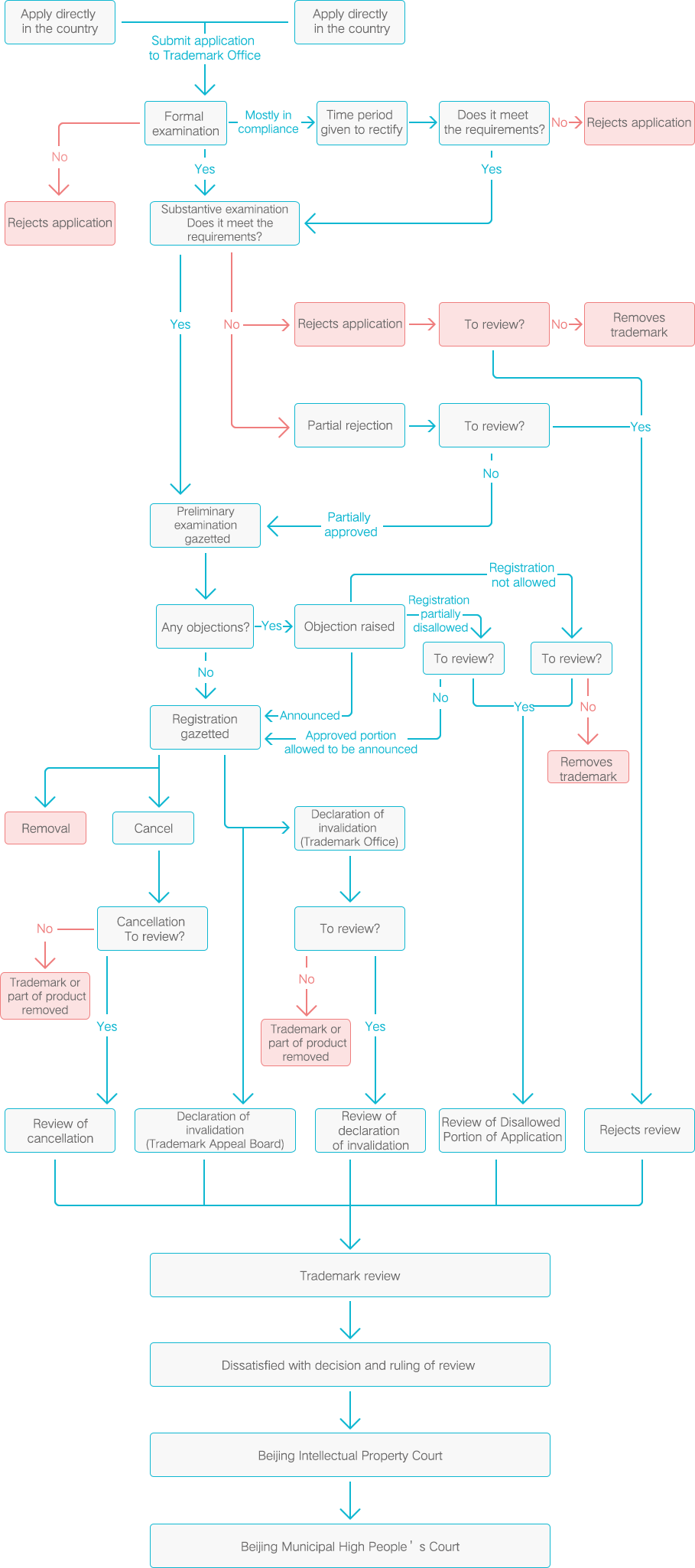

Relevant authority:Trademark Office (under the National Intellectual Property Administration)A trademark is the identifying mark for a business, which is therefore useful for keeping business activities in order.

Chinese website of Trademark Office:http://sbj.saic.gov.cn

English website of Trademark Office:http://home.saic.gov.cn/sbj/sbjEnglish

The applicant may submit a trademark registration application via the online services system.

Website of the online trademark services system: http://sbj.saic.gov.cn/wssq/

Address: Counter 25-27, Administrative Services East Hall, Civic Center, Fuzhong 3rd Road, Futian District, Shenzhen, Guangdong Province

Telephone enquiry: 0755-88127758

b.Go to the trademark registration hall of the Trademark Office.

Trademark Office Trademark Registration Hall Office Address: No. 1, Chama South Street, Xicheng District, Beijing Post

Code: 100055

Office hours: 8:30-11:30 13:30-16:30

support hotline:86-10-63218500

③The applicant entrusts the trademark agency that has filed with the Trademark Office for processing.

Query before the trademark registration application (non-essential procedure) → Prepare the application form → Submit the application form in the acceptance window → Confirm the submission of the application in the coding window → Pay the trademark fee at the payment window → Receive the receipt of the fee

Applicants can voluntarily choose any trademark agency that has been filed with the Trademark Office.

it is recommended to submit the application after the judgment of the trademark inquiry result. Otherwise, if the application is rejected, the trademark registration fee and more waiting time will be lost.

To apply for trademark registration, the following documents should be submitted:

①《Trademark Registration Application》

a.Each application for trademark registration shall submit one copy of the “Application for Trademark Registration” to the Trademark Office.

b.《The Trademark Registration Application can be submitted in paper or data message. If it is presented in paper form, it should be typed or printed. For details on specific data requirements, please refer to the relevant provisions of the “Online Application” section of the China Trademark Network.

c.Where the applicant is a legal person or other organization, the official seal shall be affixed at the designated position of the application; if the applicant is a natural person, the applicant shall use a pen or a signature pen to sign and confirm at the designated place.

d.When an applicant from Taiwan applies for a trademark registration application and requests priority from Taiwan, the application for trademark registration for the applicant in Taiwan shall be applied.

e.For details on completing the “Application for Trademark Registration”, please refer to the instructions attached to the “Application for Trademark Registration”.

If the applicant is a Hong Kong, Macao or Taiwan legal person or other organization, it shall submit a copy of the registration certificate of the region or country. A copy of the registration certificate of the office and resident representative office of a foreign company in China cannot be used as a copy of the identity document. If the above documents are in a foreign language, they shall be ccompanied by a Chinese translation; if they are not attached, they shall be deemed not to be submitted.

b.If the applicant is a natural person of Hong Kong, Macao and Taiwan and handles it on its own, it shall submit a copy of the "Hong Kong and Macao Residents' Travel Permit to the Mainland", the "Taiwan Residents' Travel Permit" or the "Hong Kong, Macao and Taiwan Residents' Residence Permit" within the validity period (more than one year); the applicant is abroad. If the natural person handles it by himself, he shall submit a copy of the passport and the Alien Permanent Residence Permit issued by the public security department within the validity period (more than one year), the Alien Residence Permit or the Alien Residence Permit.

a.Each trademark registration application shall submit 1 trademark design. If a trademark registration is applied for a color combination or a coloring pattern, a coloring pattern shall be submitted; if no color is specified, a black and white pattern shall be submitted.

b.The logo must be clear and easy to paste. It should be printed on clean and durable paper or replaced with photos. The length and width should be no more than 10 cm and no less than 5 cm. The trademark design should be affixed to the designated position in the Trademark Registration Application.

c.Where a trademark registration is filed with a three-dimensional mark, it shall be stated in the application form, and the use of the trademark shall be stated in the “Trademark Description” column of the “Application for Trademark Registration”. The applicant should submit a pattern that is capable of determining the three-dimensional shape, which should contain at least a three-sided view.

d.Where a trademark registration is applied for in a color combination, it shall be stated in the application form, and a textual description shall be given in the “Trademark Description” column of the “Application for Trademark Registration” to explain the use of the color code and the trademark. The trademark pattern should be a color block that indicates how the color is combined, or a graphic outline that indicates where the color is used. The graphic outline is not a trademark component and must be indicated by a dotted line and must not be indicated by a solid line.

e.Where a registered trademark is applied for by a voice mark, it shall be declared in the application form, and the sound mark shall be described in the trademark design box, and the sound sample that meets the requirements shall be submitted, and in the “Trademark escription” column of the “Application for Trademark Registration” Explain how the trademark is used.

(a)Description of the sound mark. The sound applied for use as a trademark should be described and appended with a stippling or a notation; if it cannot be described in tabs or notation, it should be described in words.

(b)Sound sample requirements:

① When submitting a sound trademark registration application by paper, the audio file of the sound sample should be stored in a CD-ROM, and there should be only one audio file in the CD.

If a voice trademark registration application is submitted through data message, the sound sample should be correctly uploaded as required.

② The audio file of the sound sample should be less than 5MB in the format wav or mp3.

③ The trademark description should be consistent with the sound sample.

If the application procedure is not complete or the application documents do not meet the requirements, and the information is required to be corrected, the application shall be corrected and returned to the Trademark Office within 30 days from the date of receipt of the notification.

The Trademark Office shall examine the application for trademark registration accepted in accordance with the relevant provisions of the Trademark Law. If it meets the requirements, it shall be initially examined and announced, and if it does not meet the requirements, it shall be rejected, and the applicant shall be notified in writing and the reasons shall be explained.

In general, the main cases of non-acceptance of trademark registration applications include (but are not limited to) the following:

·Failure to use the correct application form as required; modify the application form without authorization.

·The application does not use Chinese; the various documents, supporting documents and evidentiary materials submitted are in foreign languages, and the Chinese translation documents are not attached and the official seal of the applicant, agency or translation company is attached.

·The name of the applicant, the stamp or signature stamped on the application form, and the copy of the attached identification document are inconsistent.

·The trademark design does not comply with the provisions of Article 13 of the Implementing Regulations of the Trademark Law.

·The overseas notarization does not include the certification documents at the same time.

·No fees have been paid to the Trademark Office.

Relevant authority:Trademark Office (under the National Intellectual Property Administration)A trademark is the identifying mark for a business, which is therefore useful for keeping business activities in order.

Chinese website of Trademark Office:http://sbj.saic.gov.cn

English website of Trademark Office:http://home.saic.gov.cn/sbj/sbjEnglish

The applicant may submit a trademark registration application via the online services system.

Website of the online trademark services system: http://sbj.saic.gov.cn/wssq/

Address: Counter 25-27, Administrative Services East Hall, Civic Center, Fuzhong 3rd Road, Futian District, Shenzhen, Guangdong Province

Telephone enquiry: 0755-88127758

b.Go to the trademark registration hall of the Trademark Office.

Trademark Office Trademark Registration Hall Office Address: No. 1, Chama South Street, Xicheng District, Beijing Post

Code: 100055

Office hours: 8:30-11:30 13:30-16:30

support hotline:86-10-63218500

③The applicant entrusts the trademark agency that has filed with the Trademark Office for processing.

Query before the trademark registration application (non-essential procedure) → Prepare the application form → Submit the application form in the acceptance window → Confirm the submission of the application in the coding window → Pay the trademark fee at the payment window → Receive the receipt of the fee

Applicants can voluntarily choose any trademark agency that has been filed with the Trademark Office.

it is recommended to submit the application after the judgment of the trademark inquiry result. Otherwise, if the application is rejected, the trademark registration fee and more waiting time will be lost.

To apply for trademark registration, the following documents should be submitted:

①《Trademark Registration Application》

a.Each application for trademark registration shall submit one copy of the “Application for Trademark Registration” to the Trademark Office.

b.《The Trademark Registration Application can be submitted in paper or data message. If it is presented in paper form, it should be typed or printed. For details on specific data requirements, please refer to the relevant provisions of the “Online Application” section of the China Trademark Network.

c.Where the applicant is a legal person or other organization, the official seal shall be affixed at the designated position of the application; if the applicant is a natural person, the applicant shall use a pen or a signature pen to sign and confirm at the designated place.

d.When an applicant from Taiwan applies for a trademark registration application and requests priority from Taiwan, the application for trademark registration for the applicant in Taiwan shall be applied.

e.For details on completing the “Application for Trademark Registration”, please refer to the instructions attached to the “Application for Trademark Registration”.

If the applicant is a Hong Kong, Macao or Taiwan legal person or other organization, it shall submit a copy of the registration certificate of the region or country. A copy of the registration certificate of the office and resident representative office of a foreign company in China cannot be used as a copy of the identity document. If the above documents are in a foreign language, they shall be ;accompanied by a Chinese translation; if they are not attached, they shall be deemed not to be submitted.

b.If the applicant is a natural person of Hong Kong, Macao and Taiwan and handles it on its own, it shall submit a copy of the "Hong Kong and Macao Residents' Travel Permit to the Mainland", the "Taiwan Residents' Travel Permit" or the "Hong Kong, Macao and Taiwan Residents' Residence Permit" within the validity period (more than one year); the applicant is abroad. If the natural person handles it by himself, he shall submit a copy of the passport and the Alien Permanent Residence Permit issued by the public security department within the validity period (more than one year), the Alien Residence Permit or the Alien Residence Permit.

a.Each trademark registration application shall submit 1 trademark design. If a trademark registration is applied for a color combination or a coloring pattern, a coloring pattern shall be submitted; if no color is specified, a black and white pattern shall be submitted.

b.The logo must be clear and easy to paste. It should be printed on clean and durable paper or replaced with photos. The length and width should be no more than 10 cm and no less than 5 cm. The trademark design should be affixed to the designated position in the Trademark Registration Application.

c.Where a trademark registration is filed with a three-dimensional mark, it shall be stated in the application form, and the use of the trademark shall be stated in the “Trademark Description” column of the “Application for Trademark Registration”. The applicant should submit a pattern that is capable of determining the three-dimensional shape, which should contain at least a three-sided view.

d.Where a trademark registration is applied for in a color combination, it shall be stated in the application form, and a textual description shall be given in the “Trademark Description” column of the “Application for Trademark Registration” to explain the use of the color code and the trademark. The trademark pattern should be a color block that indicates how the color is combined, or a graphic outline that indicates where the color is used. The graphic outline is not a trademark component and must be indicated by a dotted line and must not be indicated by a solid line.

e.Where a registered trademark is applied for by a voice mark, it shall be declared in the application form, and the sound mark shall be described in the trademark design box, and the sound sample that meets the requirements shall be submitted, and in the “Trademark Description” column of the “Application for Trademark Registration” Explain how the trademark is used.

(a)Description of the sound mark. The sound applied for use as a trademark should be described and appended with a stippling or a notation; if it cannot be described in tabs or notation, it should be described in words.

(b)Sound sample requirements:

① When submitting a sound trademark registration application by paper, the audio file of the sound sample should be stored in a CD-ROM, and there should be only one audio file in the CD.

If a voice trademark registration application is submitted through data message, the sound sample should be correctly uploaded as required.

② The audio file of the sound sample should be less than 5MB in the format wav or mp3.

③ The trademark description should be consistent with the sound sample.

If the application procedure is not complete or the application documents do not meet the requirements, and the information is required to be corrected, the application shall be corrected and returned to the Trademark Office within 30 days from the date of receipt of the notification.

The Trademark Office shall examine the application for trademark registration accepted in accordance with the relevant provisions of the Trademark Law. If it meets the requirements, it shall be initially examined and announced, and if it does not meet the requirements, it shall be rejected, and the applicant shall be notified in writing and the reasons shall be explained.

In general, the main cases of non-acceptance of trademark registration applications include (but are not limited to) the following:

·Failure to use the correct application form as required; modify the application form without authorization.

·The application does not use Chinese; the various documents, supporting documents and evidentiary materials submitted are in foreign languages, and the Chinese translation documents are not attached and the official seal of the applicant, agency or translation company is attached.

·The name of the applicant, the stamp or signature stamped on the application form, and the copy of the attached identification document are inconsistent.

·The trademark design does not comply with the provisions of Article 13 of the Implementing Regulations of the Trademark Law.

·The overseas notarization does not include the certification documents at the same time.

·No fees have been paid to the Trademark Office.

Basic tax rate: 25%

Small low-profit enterprises

Effective tax rate for annual taxable income of RMB 0 to 1 million, : 5%

Effective tax rate for annual taxable income of RMB 1 to 3 million: 10%

Personal income tax is calculated at a progressive tax rate of 3% - 45% over the individual’s combined income (wages, salary, remuneration for labor, author’s remuneration, franchise royalties, etc.)

Note: The amount of personal income to be paid is based on theannual income of the taxable year deducted by RMB 60,000 (RMB 5000 for each month) and other special deductions, additional special deductions, and deductions prescribed by law.

Basic VAT rate for small-scale taxpayers: 3%

Basic VAT rate for general taxpayers: 13%

Deduction rate for purchased agricultural products is 9%

Rate for sales and imported goods is 13%

VAT is exempt for enterprises with monthly sales lower than RMB 100,000.

From January 1 to December 31 of a calendar year

1.By direct deduction from the company’s bank account through linking the company’s bank account to the tax authorities.

2.By payment through WeChat.

1.Personal income tax needs to be declared by the 15th of each month. Generally, salaries are paid monthly.

2.The VAT, corporate income tax and other relevant taxes of the previous quarter need to be declared to the tax authorities by April 15, July 15, October 15 and January 15 each year.

3.The annual financial and audit reports need to be submitted to the tax authorities by May 31 each year.

1.The legal representative/finance manager/tax executive of your company needs to register himself or herself at the tax department by means of real-name verification, as well as his or her mobile number in China. Otherwise, you will not be able to process your taxes. The registration should be made after the company has applied for a business license and made an official seal;

2.Comply with the rules when using invoices. For a sale of goods, an invoice needs to be issued to the buyer. If an invoice is not issued in accordance to the details, the tax department may suspect tax evasion, for which you may be subject to penalty;

3.The company’s operating income must be deposited in the company’s general bank account, and not in the personal bank account of the legal representative;

4.Ask for invoices from drivers or shops when travelling in cabs or dining at restaurants during business trips. Invoices are the legal proof of your activities during the business trip.

Since the financial and tax regulations of any two countries are different, naturally the tax policies in China will differ from those of other countries. For instance, tax declarations are made monthly, quarterly and annually. Failure to declare in time will result in you being blacklisted and paying a fine and an increased tax amount.

If you hire Chinese, you need to know the labor laws in China. If you hire foreigners, you should pay attention to the timely processing of work visa and other relevant procedures. When recruiting employees, special attention should be paid to the recruitment registration, legal review, labor contract, confidentiality agreement, non-competition clause setting and the need to buy social insurance and provident fund for employees.

Foreign investors in China must comply with the Special Administrative Measures (Negative List) for the Access of Foreign Investment and the Negative List for Market Access. Any business operation that goes beyond the scope of these measures will be investigated by the government and be subject to penalty.

Development and Reform Commission Order No. 19 of 2018

Special Management Measures for Foreign Investment

Access in the Free Trade Zone (Negative List) (2018 edition)

There are two ways to purchase social insurance for your employees. You may apply to the Human Resources and Social Security Bureau of Shenzhen Municipality for a company social insurance account, after obtaining an account opening permit. Alternatively, you may ask your HR personnel to complete the relevant procedures at the local social insurance authority by bringing the employment contracts and other relevant documents. To enquire about the list of documents required, you may call the Chinese-language service hotline 12333.

Finance / legal services outsourcing

During the early stages of a company, when the team is small and there is still limited understanding of the Chinese market, it may be a good idea to consider outsourcing your financial and tax/legal work.

(1) Highly professional: Tax agencies are professional in their work and promptly handle tax declarations, thus significantly reducing the risk of penalty for late declarations and damaging the company’s credibility. Engaging a legal services organization will also give you access to the quality services of professional legal teams.

(2) Reduces operational costs.

Risks of disclosure of trade information and lack of communication efficiency.

Hiring an internal finance / legal team

After a company has reached a certain size, and its continued expansion requires the prompt and immediate communication and interaction of finance/legal personnel, it may be advisable to hire an internal finance/legal team.

More secure:Prompt and immediate communication and interaction helps expedite internal financial processes.

Higher costs: More costs need to be incurred for employees’ salaries, social insurance and provident fund contributions, as well as benefits.

PricewaterhouseCoopers Shenzhen Office

34th Floor, Tower A, Kingkey 100, 5016 Shennan East Road, Luohu District, Shenzhen

www.pwccn.com/en.html

Deloittet Shenzhen

13th Floor, China Resources Building,5001 Shennan East Road, Shenzhen

www.deloitte.com/cn/en.html

Ernst & Young Shenzhen

21st Floor, China Resources Building, No. 5001 Shennan East Road, Shenzhen

www.ey.com/en_gl/

KPMG Shenzhen

15th Floor, China Resources Building, No. 5001 Shennan East Road, Shenzhen

home.kpmg/cn/zh/home.html

BDO Shenzhen

16th Floor, Building A, Shenzhen Investment International Business Center, No. 1061, Xiangmei Road, Futian District, Shenzhen

www.bdo.com.cn/en-gb/microsites/english/home

Beijing Yingke (Shenzhen) Law Firm

3rd Floor, Tower B, Rongchao Business Center, No. 6003, Yitian Road, Futian District, Shenzhen, Guangdong Province

www.yingkelawyer.com

Guangdong Sincere Qianhai Law Offices

Building 8 Qianhai Enterprise Dream Park,No.63 Qianwan 1st Road,Qianhai Shenzhen-Hongkong Modern Service Industry Cooperation Zone, Shenzhen

www.qianhailaw.cn/services

China Commercial Lam Lee Lai (Qianhai) Law Firm

Unit B, First Floor, Building 3, Enterprise Dream ParkQianhai Shenzhen-Hongkong Modern Service Industry Cooperation Zone, Shenzhen

www.hs-lll.cn/en

Global Law Office

Units B/C, 26th Floor, Tower 5, Dachong International Center, No. 39 Tonggu Road, Nanshan District, Shenzhen

www.glo.com.cn/en/

Dentons Shenzhen

3rd & 4th Floor, Block A, Shenzhen International Innovation Center, No.1006, Shennan Boulevard, Futian District, Shenzhen

shenzhen.dachenglaw.com

(1) Passport Your passport must be valid for a further six months, must have a blank page for the visa, and you need to submit a photocopy of the passport photo page;

(2) Visa application form and photo: To submit one Application Form for Visa of the People’s Republic of China, and a recent passport photo in color (light color background) showing the person’s face without wearing a hat;

(3) Legal proof of stay or residency (applicable to applicants outside their home country): If you are applying for a visa outside your home country, you must provide the original and photocopies of valid proof of your stay, residency, work or study in your host country, or your valid visa;

(4) Original Chinese passport or visa (applicable to those who were Chinese citizens but later adopted another nationality): If you are applying for a Chinese visa for the first time, you must provide the original Chinese passport and a photocopy of the passport photo page. If you have been granted a Chinese visa before, and are now applying for a visa with a renewed foreign passport, you must provide a photocopy of the original foreign passport photo page and the Chinese visa previously received (if the name on the new passport is inconsistent with the original passport, you will have to furnish the proof of name change issued by the relevant authority);

(5) Submit any other documents required according to the visa category.

Address: Administrative Services East Hall, Zone B, Civic Center, Fuzhong 3rd Road, Futian District, Shenzhen

Application counters: No. 29-31

Telephone enquiry: 0755-88121678

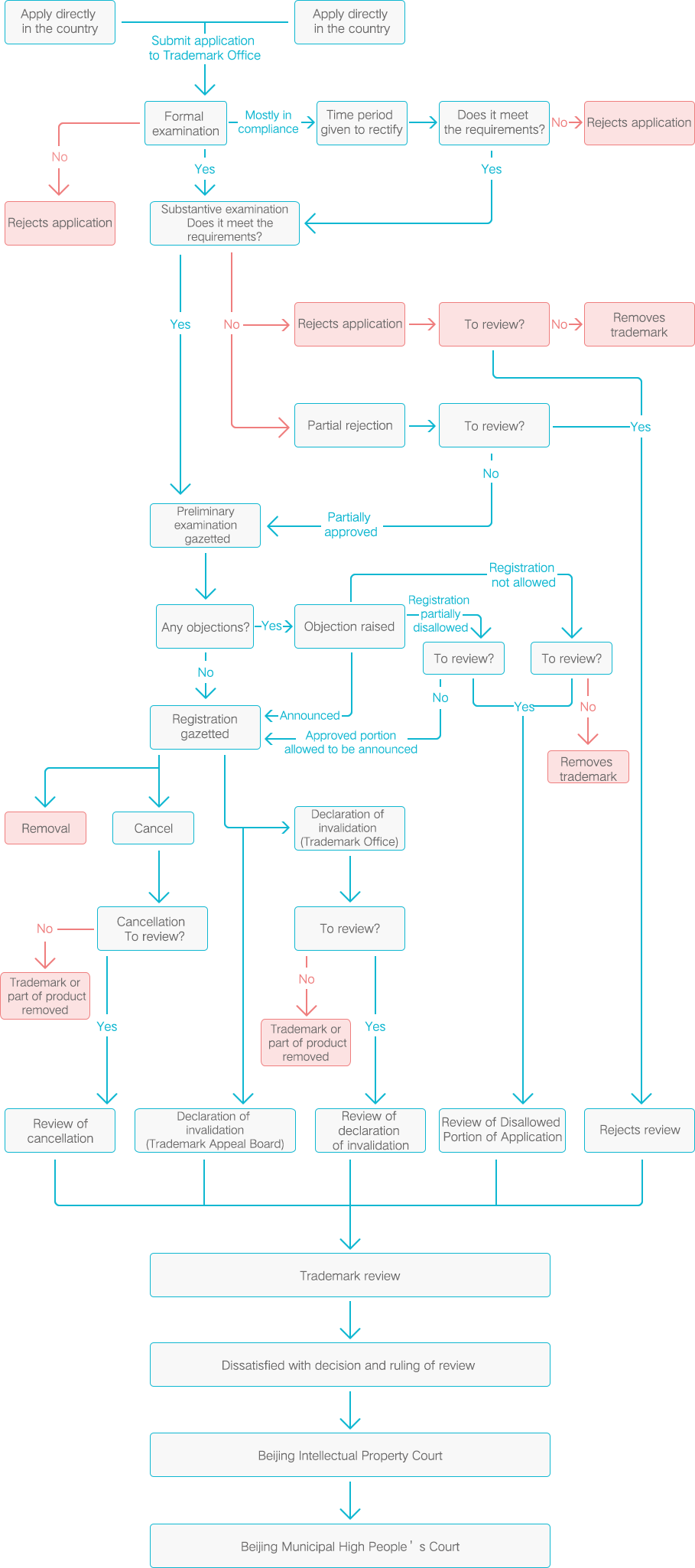

How Do Foreigners

Work Legally in China?

Processing Foreigner's Permanent

Residence Identity Card for the First Time

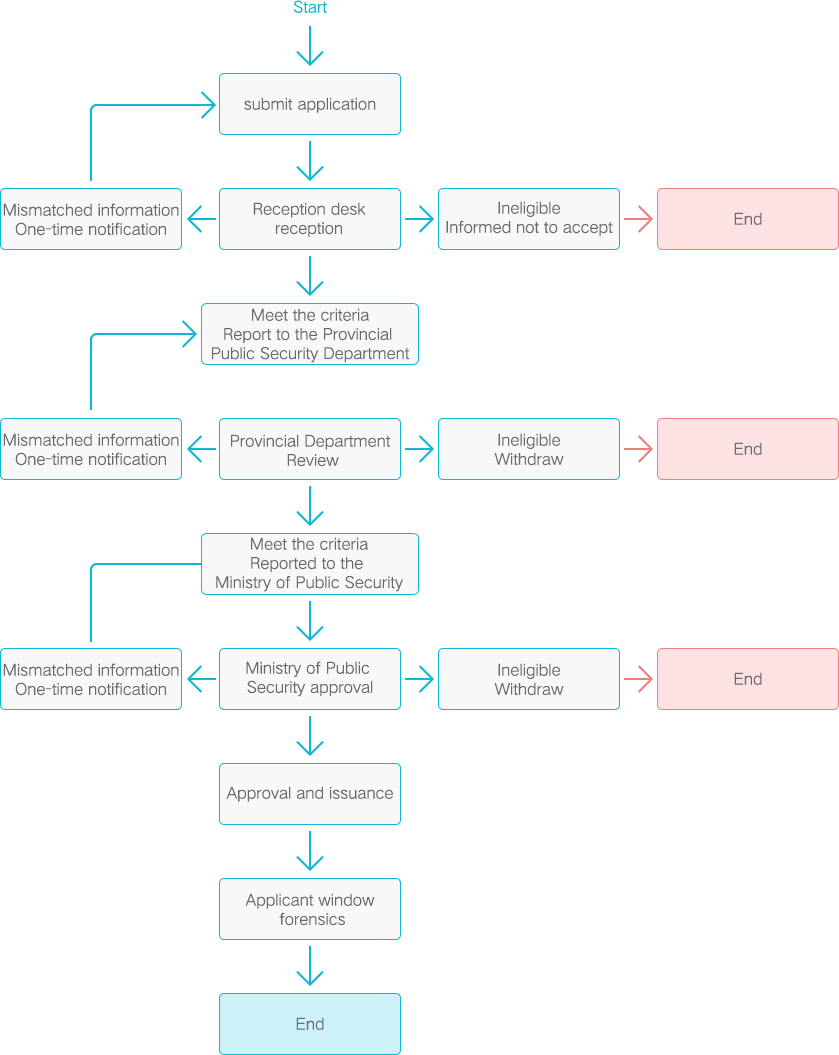

Foreigners applying for permanent residency in China must comply with the laws of China, be in good health, hold no criminal record, and meet one of the following criteria:

1、 Having direct investments in China with good performance for a consecutive three years, and having a good tax payment record;

2、Holding the position of a deputy general manager, deputy factory manager or any other similar position, or an associate professor, a research associate or any other deputy senior position in China, and receiving equivalent benefits, on a continuous tenure of more than four years, with a cumulative period of residency of not less than three years and having a good tax payment record;

3、 Foreigners who have made significant and outstanding contributions to China and are urgently needed by the country;

4、 Spouses and unmarried children not older than 18 years old of individuals referred to in item 1, 2 and 3 above;

5、Spouses of Chinese citizens or foreigners who have permanent residency in China, having been in the marriage for at least five years, having resided in China continuously for five years, during which no less than nine months each year is spent in China, and having a stable means of living and residence;

6、Unmarried children not older than 18 years who are looking to depend on their parents in China;

7、Individuals of 60 years of age or above, who do not have direct relations outside China and are looking to depend on direct relations in China, having resided in China continuously for five years, during which time no less than nine months each year is spent in China, and having a stable means of living and residence.

1、Processing fee: RMB 1500; (non-refundable even if application is rejected)

2、Fee for Foreigner’s Permanent Resident Card: RMB 300.

1、Documents of proof issued by foreign authorities must be notarized by the Chinese embassy or consulate in that country.Documents in a foreign language must be translated into Chinese, and the translation document and the photocopy of the business license of the translation company must be stamped with the seal of the translation company.

2、 If the applicant wants their Chinese name typed on the Foreigner’s Permanent Resident Card, they must specify “please include Chinese name XXX on the card” in the “Other Details” section on the application form, otherwise it may be filled in as “N/A”.

3、If any matter requires investigation and verification by the public security authorities, the period of investigation shall not include working days. Currently, the time required to process a permanent residency application is around one year.

1、Bureau of Exit and Entry Administration of the Shenzhen Municipal Public Security Bureau

Address: No. 4016, Jiefang Road, Luohu District, ShenzhenTel No.: 844654902、Management Committee of Shenzhen’s Qianhai Shekou Free Trade Zone

Address: Integrated Office for the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone, South of Intersection of Dongbin Road and Yueliangwan Boulevard, Nanshan District, ShenzhenTelephone enquiry: 889889883、Shenzhen Administration of Foreign Experts Affairs

Address: Shenzhen Talent Park, No. 8005, Shennan Boulevard, Futian District, ShenzhenTelephone enquiry:881234564、Overseas Chinese Affairs Office of Shenzhen

Address: 6th - 7th Floor, Second Municipal Government Office, No. 1023, Shangbu Middle Road, Futian District, ShenzhenTelephone enquiry:881361675、Shenzhen Port Hospital

Address: Huanggang Port Residential Area, Binhe Boulevard, Fujian District, ShenzhenTelephone enquiry:83774013

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

For more detaills

please scan the QR code

Remarks: Processing time indicated is for reference only.

Remarks: Processing time indicated is for reference only.

Natural person

(Wholly foreign-owned)

1.Shareholders provide personal notarized certificates or sign before the application submission personnel at the local registration hall;

2.Photocopies of identification documents of shareholders, directors, supervisors, managers and finance executives (Hong Kong and Macau residents: Mainland travel permits and personal identification cards; Foreigners: Passports; Taiwanese: Mainland travel permits for Taiwan residents)

3.Original passports of shareholders;

4.Photocopies of personal identification cards of designated recipients of legal documents (who must be a Chinese national)

5.Application Form for Company Registration (Joint Issuance of Business License and Social Credit Code) (downloadable on website)

6.Corporate charter (template downloadable on website)

7.Letter of appointment

8.Office leasing agreement and proof

(to be provided according to relevant local requirements)

Corporate legal person

(Wholly foreign-owned)

1.Proof of legal entity status of foreign investors;

2.Photocopies of identification documents of directors, supervisors, managers and finance executives (Hong Kong and Macau residents: Mainland travel permits and personal identification cards; Foreigners: Passports; Taiwanese: Mainland travel permits for Taiwan residents)

3.Photocopies of personal identification cards of designated recipients of legal documents (who must be a Chinese national)

4.Application Form for Company Registration (Joint Issuance of Business License and Social Credit Code) (downloadable on website)

5.Corporate charter (template downloadable on website)

6.Letter of appointment

7.Office leasing agreement and proof (to be provided according to relevant local requirements)

Chinese-foreign jointventure enterprises

1.The Chinese shareholder must be a legal entity and not a natural person. The photocopy of the business license stamped with the company’s seal is to be provided;

2.The foreign shareholder can be a natural person or legal entity. The natural person shareholder shall provide his or her personal notarized certificate or sign before the application submission personnel at the local registration hall. The legal entity shareholder shall provide proof of their legal entity status as a foreign investor;

3.Photocopies of identification documents of directors, supervisors, managers and finance executives (Hong Kong and Macau residents: Mainland travel permits and personal identification cards; Foreigners: Passports; Taiwanese: Mainland travel permits for Taiwan residents)

5.Application Form for Company Registration (Joint Issuance of Business License and Social Credit Code) (downloadable on website)

6.Corporate charter (template downloadable on website)

7.Letter of appointment

8.Office leasing agreement and proof (to be provided according to relevant local requirements)

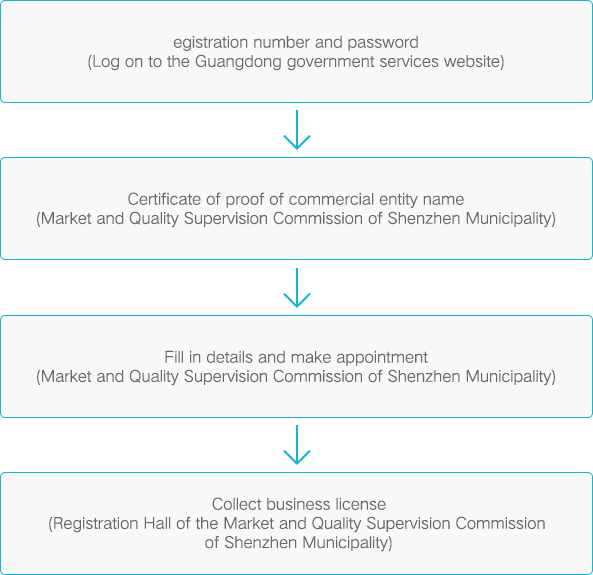

1.Proof of commercial entity name of foreign-invested enterprise (download at Step ② of the declaration process);

2.Letter of Commitment for Record-Filing for Registration of Foreign-Invested Enterprise (template downloadable on website);

3.Proof of legal entity status or natural person identity of investors;

4.Foreign-invested enterprises set up a filing application power of attorney (download sample on the website);

5.Proof of natural person identity of legal representative;

6.Shareholding framework of actual controlling persons of foreign-invested enterprise (template downloadable on website).

Electronic One-Stop Service Center Hall

(Qianhai Bureau of Industry and Commerce)

One-Stop Service Center Hall A105, Building A, No. 1, Qianwan 1st Road, Qianhai Shenzhen-Hong Kong Cooperation Zone, Shenzhen

1st Floor, Luohu Management Center Building, No. 1008, Wenjin Middle Road, Luohu District, Shenzhen

Administrative Services Hall of Nanshan District, Shenzhen Bay Sports Center, No. 3001, Binhai Boulevard Side Road, Nanshan District

(Single building south-east of Shenzhen Bay Sports Center)

1st Floor, Integrated Training Building of Bao’an Sports Center, Intersection of Bao’an Boulevard and Luotian Road, Bao’an District, Shenzhen

(Opposite the Bao’an Immigration Permit Application Hall)

No. 8033-1, Longxiang Boulevard, Longcheng Subdistrict, Longgang District

(south-west of main gate of District Government Office)

1st Floor, Yantian Sub-Bureau, No. 1013, Haijing 2nd Road, Shatoujiao, Yantian District

Administrative Services Hall of Guangming District, Biyan Road, Guangming District, Shenzhen

2nd Floor, Qixing Building, No. 12, Jinniu West Road, Pingshan District

No. 10, Zhongshan Road, Dapeng Boulevard, Dapeng New District, Shenzhen

1st Floor, Block A, Guohong Building, No. 98, Meilong Boulevard, Longhua District, Shenzhen

After successfully registering with the Market and Quality Supervision Commission of Shenzhen Municipality, the company’s legal representative will receive a verification code sent through the “Government Affairs Messaging Platform”. With the verification code, the company can have its seals made either online or at any physical seal-making shop.

(1)Official seal/administrative seal (required for opening business bank accounts)

(2)Financial seal (required for opening business bank accounts)

(3)Legal representative’s personal seal (with personal name) (required for opening business bank accounts)

(4) Invoice seal (to stamp on invoices)

(5)Agreement seal (for signing of agreements)

Remarks:

Under the line engraved chapters engraved chapters, must carry information:

Original/copy of the business license;

Original legal representative passport;

The original ID of the manager.

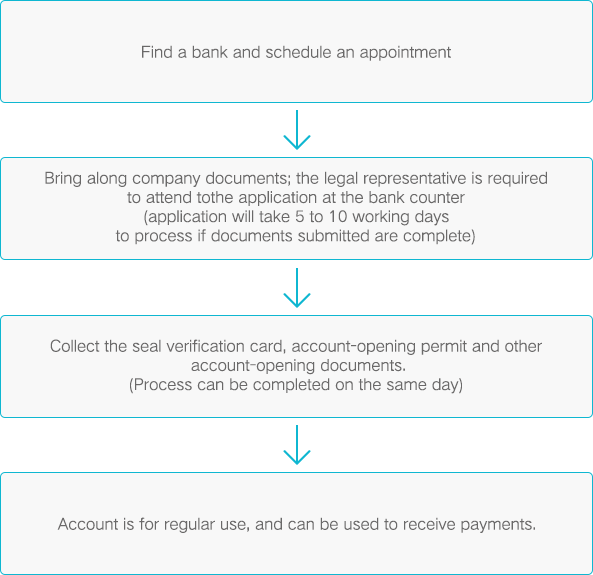

Once the business license and company seals are ready, the company can begin its operations. If the company wants to deal with payments in its name with suppliers, a business bank account will be needed. The company cannot provide the bank account details of its shareholders to the suppliers, as this might lead the tax authorities to suspect tax evasion.

① Basic account (required, and only one allowed). A basic account is the first bank account that an enterprise needs. You must first have a basic account to be able to open other accounts. A basic account allows you to deposit and withdraw funds, transfer or receive payments, pay withholding tax, pay wages, etc.

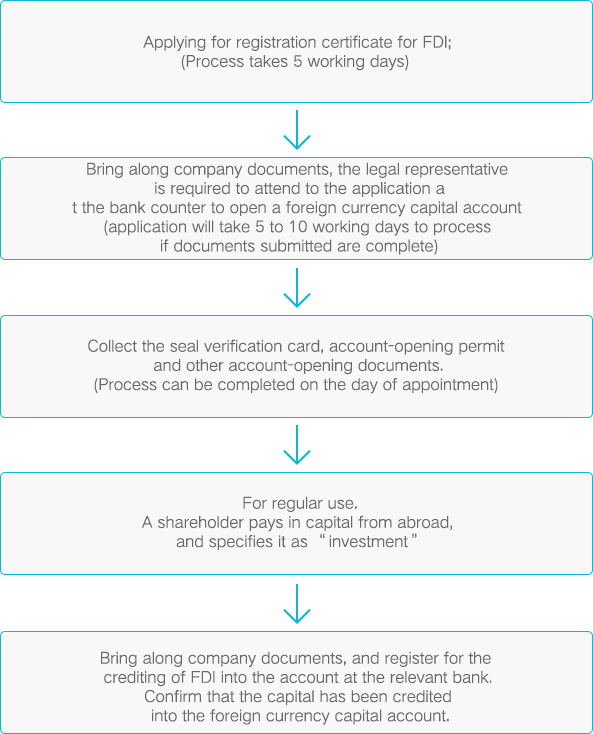

② Foreign currency capital account (required for foreign-invested enterprises):

This is an account for receiving capital paid by Chinese and foreign shareholders in foreign currencies. When making payments from a foreign bank to a foreign currency capital account in China, the purpose of payment must be stated as “investment” or “capital”. This is to make it easier for the auditor to identify the amount as capital in the capital verification report or audit report.At the same time, the bank will have set certain rules regarding the use of the registered capital in accordance to the instructions and requirements of the Administration of Foreign Exchange. Please be sure to adhere to the specific requirements of each bank. For example: A foreign trade company that intends to make payments to its suppliers must present the relevant signed agreements, invoices and other documents at the bank counter to apply for the account before it is able to make any overseas payments.

③General account (not required, multiple accounts allowed)

An enterprise may open a general account locally, which allows for the deposit of cash, but not withdrawal. Only bank transfers are allowed, as well as payment of withholding tax.

After learning about the different types of business bank accounts available, Leanne has the following question: Where should I open the accounts, then?

in China, you can call the customer service number of each bank, such as Bank of China: 95566. You can tell the bank which bank you want to open a company bank account in, and the bank customer service staff will also inform you of the bank's phone number and address. Next, you can call the bank phone or at the address provided by the customer service to ask at the bank counter. The information to be understood.

1.You can choose any bank near you. You can take a look at the area where your office is for any suitable bank. It might be good to choose a bank close to your office, as it’ll save time when the company is in operation and you will need to go to the bank every so often for banking errands.

2.Choose a bank you are familiar with. If you have used Bank of China before while overseas, then you can once again open a business account at a Bank of China branch in Shenzhen. It can be easier to learn more about the bank when you are already familiar with its operation and management.

1.You may schedule an appointment on the phone with the bank staff;

2.You may walk in and make an appointment at your selected bank;

3.You may also schedule an appointment through the bank’s website or the bank’s WeChat public account. The public account only provides services in Chinese, and to use it you must have a Mainland China mobile number that can receive mobile phone verification codes from Mainland China.

1.Account-opening fee;

2.Account management fee (usually paid monthly);

3.USB Key processing fee;

4.Online banking management fee (paid monthly or quarterly);

5.Bank transfer fee.

1.Original business license of the company;

2.Original office leasing agreement and proof;

3.Original trust agreement for company office in Qianhai (required for enterprises in the Qianhai Free Trade Zone)

4.The legal representative needs to attend to the application in person at the bank account, and have his or her picture taken by the bank employee;

5.Original passport of the legal representative;

6The company’s official seal, financial seal, and legal representative’s personal seal;

7.Original passport of the company’s online banking executive;

8.Original passports of natural person shareholders.

The bank employee may ask the legal representative the following questions when handling the application in person:

1.What is the registered address of the company? Is it the same as the company’s office address?

2.What is the main business area of the company?

3.How many employees does the company currently have?

4.Who are the company’s shareholders? What are their capital shares?

5.Why do you want to open a bank account?

1.Original business license;

2.Original office leasing agreement and proof;

3.Original and photocopy of the passport of the legal representative (whether he or she needs to be at the bank in person depends on the bank’s requirements);

4.Original and photocopy of the account-opening permit;

5.Company’s official seal, financial seal, and legal representative’s personal seal;

6.Original receipt of acknowledgement of record-filing for registration of foreign-invested enterprises;

7.Original record-filing declaration form for registration of foreign-invested enterprises;

8.Original corporate charter;

9.Original personal identification card of application representative;

10.Photocopy of business license of domestic enterprise shareholders stamped with the official seal (required for Chinese-foreign joint venture enterprises);

11.Photocopies of passports of foreign natural person shareholders;

1.Original business license;

2.Original office leasing agreement and proof;

3.Original trust agreement for company office in Qianhai (required for enterprises in the Qianhai Free Trade Zone)

4.The legal representative needs to attend the application in person at the bank, and have his or her picture taken by the bank employee;

5.Original and photocopy of the passport of the legal representative;

6.Company’s official seal, financial seal, and legal representative’s personal seal;

7.Original and photocopy of the passport of the payment contact person;

8.Original receipt of acknowledgement of record-filing for registration of foreign-invested enterprises;

9.Original record-filing declaration form for registration of foreign-invested enterprises;

10.Original corporate charter;

11.Original personal identification card of application representative;

12.Original business registration certificate.

Incoming transactions for a capital account include: Foreign currency capital or subscribed capital remitted by foreign investors, and its interest.

Outgoing transactions for a capital account include: Financial exchange settlement for business operations, debited payments due to reduction or withdrawal of capital by foreign investors, payment for goods and services to suppliers, wages, withdrawal of capital reserves (the total amount withdrawn monthly by a company from its capital reserves must not exceed the equivalent of $100,000 USD.)

How are payments for goods or services made from a capital account?

Any direct payment for goods or services to suppliers from a capital account can only be made by the bank after the account holder has submitted relevant documents to the bank counter.

1.Service trading. To submit documents such as the service agreement and invoices;

Goods trading. To submit documents such as agreements, invoices, and customs bills of payment.